AN OVERVIEW OF BITCOIN

Bitcoin is the most well-known digital currency to date. So well known, that when most of the world hears the term “cryptocurrency,” Bitcoin comes to mind. It is often referred to as the “grandfather of blockchain-based digital currencies”. This is because it was a novel idea at launch, and it has paved the way for a whole new industry with potential for new financial standard. Despite the currency being the first of its kind, it has since shown its age in several ways. For instance, some common points of criticism include: large energy consumption, high transaction fees, and slow, cumbersome speed. Several blockchain-based digital currencies have been created since Bitcoin’s inception. These new currencies improve on the existing concepts and seek to resolve the problems observed in Bitcoin.

Bitcoin (commonly abbreviated as “BTC”) was launched in January of 2009, by an anonymous individual or group of individuals under the pseudonym, “Satoshi Nakamoto,” whose identity remains a mystery to date. Bitcoin revolutionized digital currency by utilizing blockchain with a novel Proof of Work technology at its core, and this is the most important nuance that differs it from digital currencies before its time. Since Bitcoin is a digital currency, there are no physical or tangible coins that can be held like fiat currency. Instead, the coins are digitally stored on the Bitcoin ledger. Bitcoin can be bought and traded through online exchanges and users are able to store and access their funds through verifiable identities known as “wallets.” These wallets do not contain the actual coins themselves, but instead, hold the key to accessing the funds stored on the blockchain. Bitcoin has ultimately led to a multi-trillion-dollar cryptocurrency industry.

Bitcoin only has one blockchain, and it is commonly referred to as the “Bitcoin Blockchain.” Each of its blocks contain a record of all Bitcoin transactions that occurred before that specific block reaches its data limit and becomes full. All Bitcoin transactions can be viewed in real-time by anyone, and the history of all transactions that have happened on the blockchain can also be traced. The blockchain acts as a historical ledger of all transactions that have happened since its inception, and this is one of the key components of how Bitcoin ensures that transactions are valid and not fraudulent. The network participants all keep a record and constantly compare the records to ensure a legitimate record of transfers, ownership, and spending.

HOW BITCOIN WORKS

The record-keeping and transparent nature of Bitcoin’s blockchain is integral for validating transactions and ensuring integrity across the system. The currency is considered “decentralized,” which means that it is unregulated by any one central authority. Instead, regulation is accomplished by node consensus. But what is a node to begin with?

What is a node?

A node, also referred to as a “miner,” is simply a computer that is both:

- running Bitcoin’s code in real-time; and

- storing the entirety of the Bitcoin blockchain.

Who can become a node?

Anyone can turn their computer into a node if they wish. As of June 2021, there are around full 10,000 Bitcoin nodes actively running. For example, Slushpool has over 200,000 users who have joined mining pools. Mining pools are a way for individual users with small computing power to contribute to a larger mining operation. The pool users share rewards that are relative to the contribution to the Proof of Work, without running a “full-node”. Together, these nodes act as the warden for governing validation and integrity over the entire system.

The role of nodes

When transactions occur, the nodes actively compare each other to ensure validation. For a transaction to be approved, it must be validated by 51% of all the Bitcoin computational power. If a transaction is detected as being fraudulent and does not match the blockchain records, it will be declined and not put into the queue for processing. Since every single node will contain the exact same copy of transactions and block history, it is near impossible to commit fraudulent transactions. Due to this decentralized exchange of information, Bitcoin is classified as a “peer-to-peer” network.

Any network that exchanges data between parties without any central authority can be classified as peer-to-peer, or “P2P” for short.

MINING BITCOIN

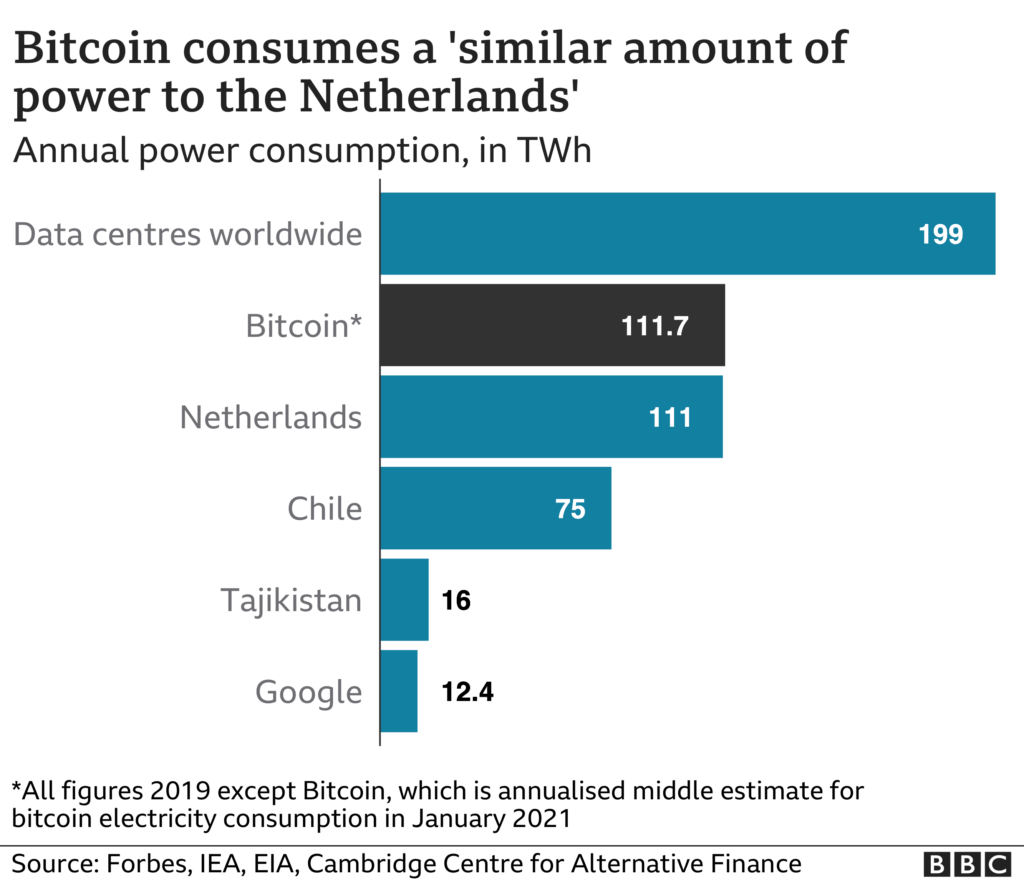

“Bitcoin mining,” is the process of using nodes (or miners), which we briefly described above, to solve complicated mathematical equations which effectively allow a coin transaction to be processed and new coins to be produced. This is based around the core of Bitcoin’s network, utilizing the Proof of Work consensus algorithm. For the work to be accomplished, the owners of the computers are rewarded with Bitcoin. For the Bitcoin network to operate, it requires massive amounts of energy to ensure the payment network is verified and secure, as well as to produce new coins. According to the Cambridge Center for Alternative Finance (CCAF), Bitcoin consumes roughly 0.55% of all global electricity production. This is more than the annual power consumption of entire countries such as Sweden or Finland.

Bitcoin has also proven itself to be slow and unscalable as the years have passed. It also has become increasingly expensive to process a transaction. As we have already established, to perform transactions, mining computers must solve mathematical problems which consume tremendous energy. Additionally, the devices with the highest computing power have the highest chance of forging the next block and earning a reward. Consequently, this has led to a never-ending competition to obtain as much computing power as possible. Which in turn has led to an ever increasing demand on local and national energy grids.

Additionally, when an individual wants to make a transaction, they must set a transaction fee (gas, for Ethereum) which will be offered as a reward and incentive for miners. Since miners can pick what they process, often choosing the highest bidder, transactions with lower costs can hang, driving the price per transaction higher, and extending completion time.